Jakarta, SenayanTalks — Global measurement and analytics company Adjust has released its latest Mobile App Growth Report: 2025 Edition, revealing that despite privacy changes and rising costs, the global mobile app economy continues to grow steadily.

According to the report, global app installs increased by 11% and sessions by 10% year-over-year (YoY) in the first half of 2025. This growth comes as marketers embrace AI-driven insights, personalized targeting, and user retention strategies to stay competitive in a rapidly evolving landscape.

The Asia-Pacific (APAC) region emerged as the global growth leader, driven by strong performance in gaming and entertainment apps.

“The challenge for marketers today isn’t a lack of data, but identifying which signals truly matter,” said Tiahn Wetzler, Director of Content and Insights at Adjust. “With engagement and retention now as critical as installs and cost efficiency, we developed the Growth Score—a benchmark helping marketers prioritize investment, capture opportunities, and sustain growth. This clarity is most evident in the Asia-Pacific region this year.”

Global App Market Performance

For this year’s report, Adjust analyzed over 5,000 leading apps worldwide to identify how and where the mobile app economy is expanding, as well as where user acquisition potential remains strongest.

The Growth Score combines four weighted metrics—installs, cost per install (CPI) efficiency, sessions per user per day, and user retention—to provide a balanced benchmark of scale, efficiency, and quality.

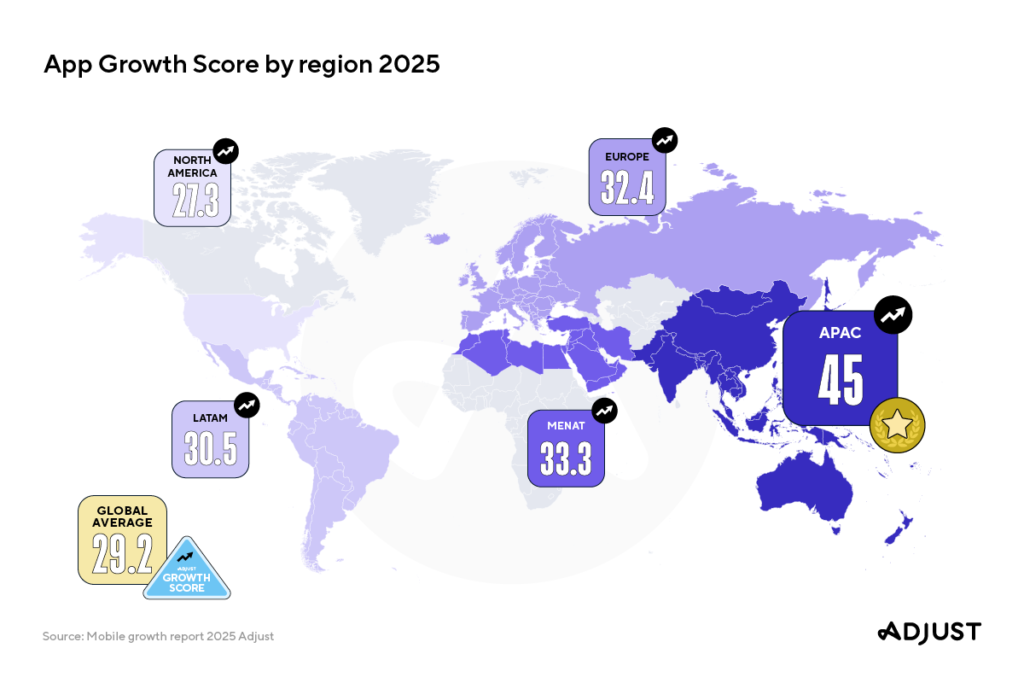

The global average Growth Score in 2025 is 29.2, which Adjust uses as a universal reference to compare app performance across regions, countries, and verticals.

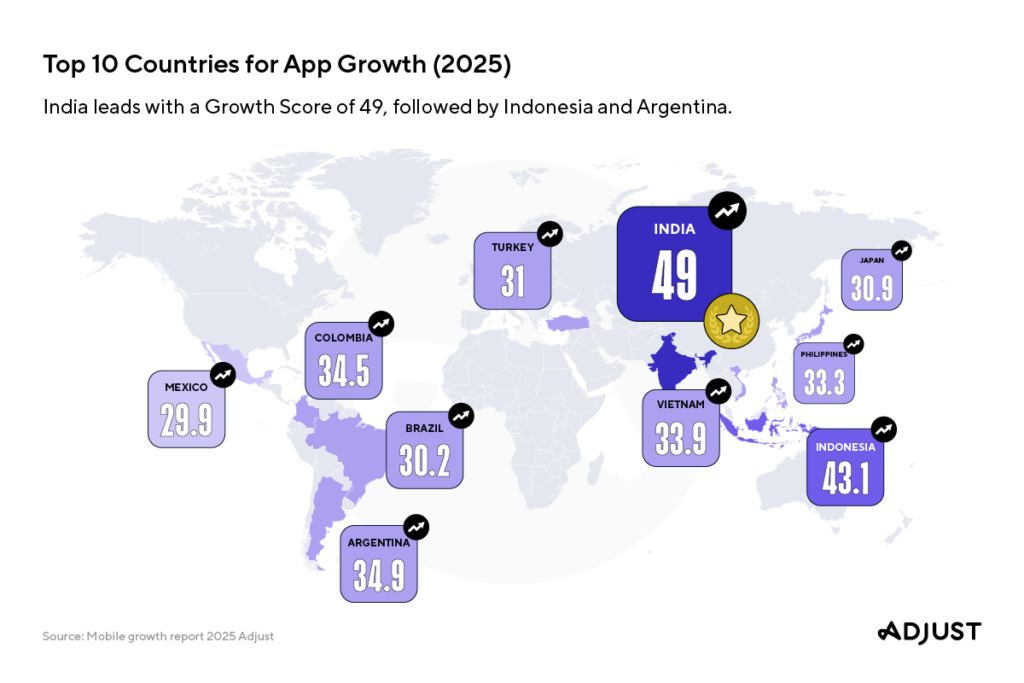

Asia-Pacific leads all global regions with a Growth Score of 45, well above the global average. The region’s success stems from its combination of scale, cost efficiency, and strong user engagement—particularly in emerging markets such as India (49) and Indonesia (43.1).

Other high-performing countries include Vietnam (33.9), the Philippines (33.3), Japan (30.9), and Malaysia (29.9)—each reflecting the balance between user retention and monetization in both emerging and mature app markets.

Gaming Dominates the APAC App Landscape

Gaming remains the most dominant vertical in Asia-Pacific, scoring 37 on Adjust’s Growth Index and outperforming other app categories.

Sub-verticals such as music (41.2), card (35.7), and board games (34.6) continue to drive engagement, reflecting a vibrant and diverse regional gaming culture.

The Asia-Pacific gaming industry is projected to generate US$66.7 billion in 2025, the largest share globally. This surge is fueled by a young population, growing e-sports popularity, and the expansion of hybrid monetization models combining multiple revenue streams.

India leads globally in the gaming category with a Growth Score of 52.2, supported by 650 million mobile gamers and extremely low acquisition costs of just US$0.03 per install in early 2025.

Indonesia (40.1) and Vietnam (36.2) also rank among the world’s fastest-growing gaming markets.

Beyond gaming, entertainment apps achieved a score of 31.9, fueled by rising demand for video and social media platforms, while utility (28.6) and photo & video (26.7) apps also performed strongly.

Meanwhile, finance (22.9) and shopping (22.6) categories reflect APAC’s shift toward mobile banking and e-commerce-driven experiences.

Monetization Potential

While Asia-Pacific leads, other regions also show strong fundamentals. MENAT (Middle East, North Africa, and Turkey) recorded a Growth Score of 33.3, followed by Europe (32.4) and Latin America (30.5), with markets like Argentina experiencing rapid expansion.

North America (27.3) remains a high-value but mature market, where app monetization takes precedence over user acquisition.

Across sectors, gaming apps maintain the highest global Growth Score (45.8), followed by marketplaces & classifieds (40.8), news & magazines (36.4), and banking apps (33.6).

“The momentum we’re seeing in Asia-Pacific reflects a fundamental shift in how consumers engage with mobile apps,” said April Tayson, Regional Vice President for INSEAU at Adjust. “From gaming to finance, users now demand more immersive and value-driven experiences—and this innovation will define the next phase of the global app economy.”

As marketers continue adapting to a privacy-first, AI-powered era, Adjust’s Mobile App Growth Report 2025 highlights that data-driven insights, retention focus, and creative monetization models will be key to sustaining long-term success in the ever-competitive mobile ecosystem.

You might also like :